![[GALLERY] How Southern Tier Property Tax Stacks Up Against The Rest Of New York](http://townsquare.media/site/497/files/2022/02/attachment-Property-Taxes.jpg?w=980&q=75)

[GALLERY] How Southern Tier Property Tax Stacks Up Against The Rest Of New York

Don't we all just love paying taxes? Okay, don't bite my head off. Remember the quote from Benjamin Frankin? “Our new Constitution is now established, everything seems to promise it will be durable; but, in this world, nothing is certain except death and taxes...”

And that's the way it will always be. So speaking of taxes, we love to complain about our property taxes. Wouldn't it be nice if when we reach a certain age, during our retirement years we were no longer required to pay property taxes? That would be a wonderful thing. Well, that chance is slim to none, and, well you know the rest.

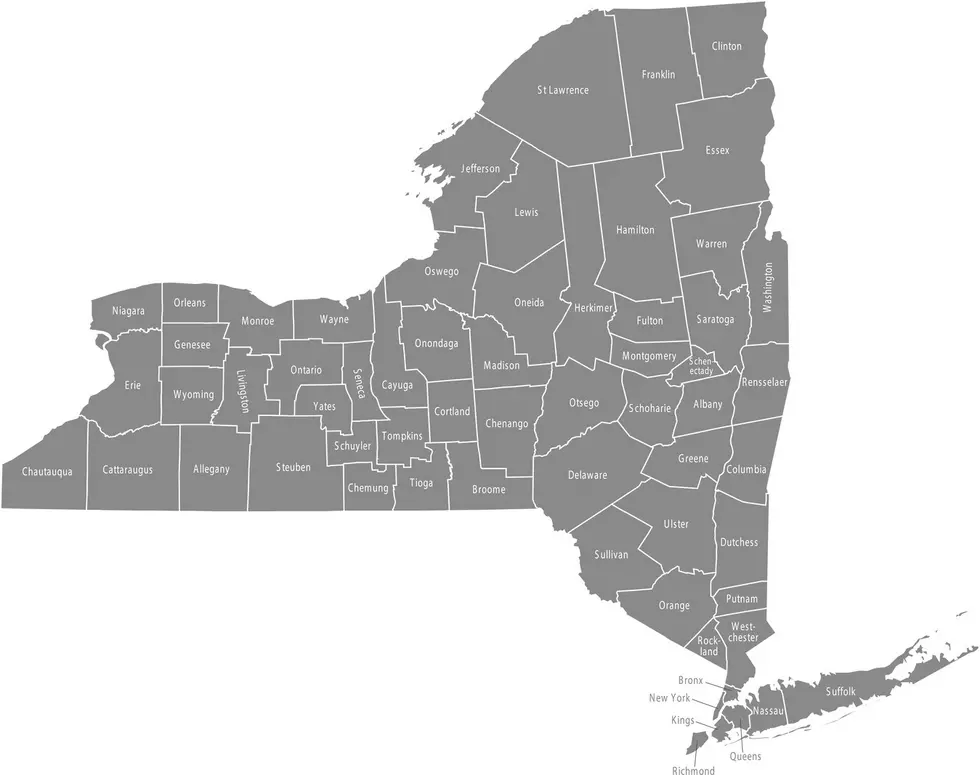

Anyway, since property taxes are a part of homeowner life, we thought it would be interesting to take a look at how Southern Tier property tax stacks up against other areas in the State of New York.

According to the Tax Rates website, the median property tax in New York State comes in at $3,755 dollars for a home with a median value of $306,000 dollars. In Broome County, that number is $2,417 dollars and in Tioga County, it's $2,354 dollars.

Tax Rates notes that New York State is the fourth highest state in the nation for property taxes. Westchester County comes in at the top for the highest amount paid in property taxes at $9003 dollars. The lowest is St. Lawrence County coming in at $1674 dollars.

Below, you can see the breakdown of the top 10 property tax counties in New York State, along with the average rates for counties in the Southern Tier of New York.

via Tax Rates

New York Counties With The Highest Property Taxes

Local Landmarks In Four Words

Re-Live Your Childhood Memories at This Enchanting Park in the Adirondacks

40 Reasons You’ll Fall in Love With a Renaissance Faire

More From 99.1 The Whale